Federal Reserve Board Chairman Jerome Powell departs after talking throughout a information convention following the Federal Open Market Committee assembly, on the Federal Reserve in Washington, DC, on June 14, 2023.

Mandel Ngan | AFP | Getty Pictures

The Federal Reserve plans to maintain mountaineering rates of interest to stem inflation, which suggests a rise in company default charges is probably going in coming months.

The company default fee rose in Might, an indication that U.S. corporations are grappling with larger rates of interest that make it costlier to refinance debt in addition to an unsure financial outlook.

There have been 41 defaults within the U.S. and one in Canada thus far this 12 months, essentially the most in any area globally and greater than double the identical interval in 2022, in response to Moody’s Buyers Service.

Earlier this week, Fed Chairman Jerome Powell stated to anticipate extra rate of interest will increase this 12 months, albeit at a slower fee, till extra progress is made on reducing inflation.

Bankers and analysts say excessive rates of interest are the most important wrongdoer of misery. Corporations which can be both in want of extra liquidity or those who have already got hefty debt hundreds in want of refinancing are confronted with a excessive price of recent debt.

The choices typically embrace distressed exchanges, which is when an organization swaps its debt for one more type of debt or repurchases the debt. Or, in dire circumstances, a restructuring could happen in or out of courtroom.

“Capital is way more costly now,” stated Mohsin Meghji, founding accomplice of restructuring and advisory agency M3 Companions. “Have a look at the price of debt. You could possibly moderately get debt financing for 4% to six% at any level on common during the last 15 years. Now that price of debt has gone as much as 9% to 13%.”

Meghji added that his agency has been significantly busy for the reason that fourth quarter throughout quite a few industries. Whereas essentially the most troubled corporations have been affected not too long ago, he expects corporations with extra monetary stability to have points refinancing on account of excessive rates of interest.

Via June 22, there have been 324 chapter filings, not far behind the full of 374 in 2022, in response to S&P World Market Intelligence. There have been greater than 230 chapter filings by April of this 12 months, the very best fee for that interval since 2010.

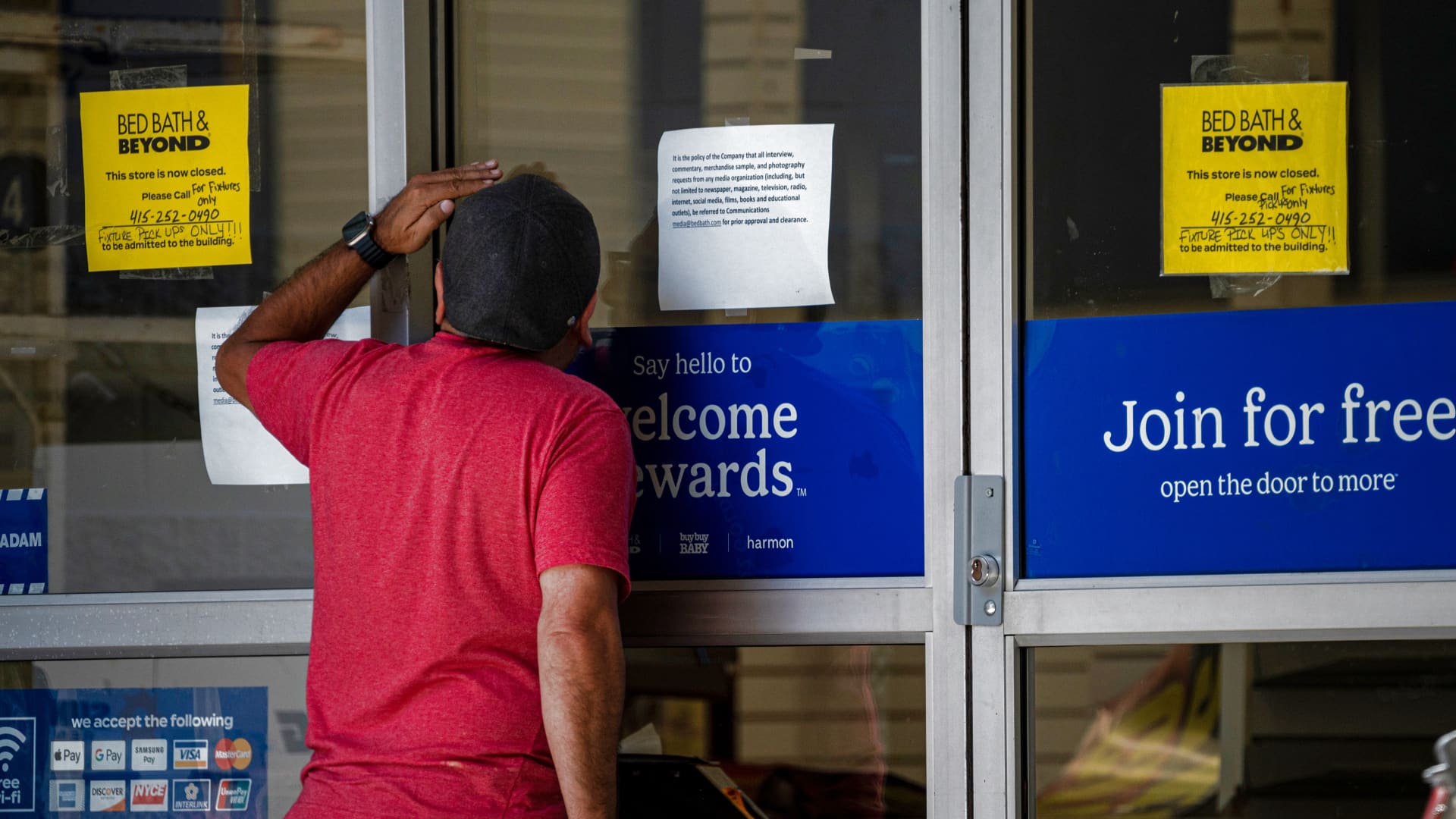

A closed Mattress Tub & Past retailer in San Francisco, California, US, on Monday, April 24, 2023.

David Paul Morris | Bloomberg | Getty Pictures

Envision Healthcare, a supplier of emergency medical companies, was the most important default in Might. It had greater than $7 billion in debt when it filed for chapter, in response to Moody’s.

Residence safety and alarm firm Monitronics Worldwide, regional monetary establishment Silicon Valley Financial institution, retail chain Mattress Tub & Past and regional sports activities community proprietor Diamond Sports activities are additionally among the many largest chapter filings thus far this 12 months, in response to S&P World Market Intelligence.

In lots of instances, these defaults are months, if not quarters, within the making, stated Tero Jänne, co-head of capital transformation and debt advisory at funding financial institution Solomon Companions.

“The default fee is a lagging indicator of misery,” Jänne stated. “A number of occasions these defaults do not happen till nicely previous quite a lot of initiatives to deal with the stability sheet, and it is not till a chapter you see that capital D default come into play.”

Moody’s expects the worldwide default fee to rise to 4.6% by the top of the 12 months, larger than the long-term common of 4.1%. That fee is projected to rise to five% by April 2024 earlier than starting to ease.

It is protected to guess there will likely be extra defaults, stated Mark Hootnick, additionally co-head of capital transformation and debt advisory at Solomon Companions. Till now, “we have been in an atmosphere of extremely lax credit score, the place, frankly, corporations that should not be tapping the debt markets have been in a position to take action with out limitations.”

That is doubtless why defaults have occurred throughout varied industries. There have been some industry-specific causes, too.

“It is not like one explicit sector has had a whole lot of defaults,” stated Sharon Ou, vp and senior credit score officer at Moody’s. “As a substitute it is fairly quite a lot of defaults in numerous industries. It will depend on leverage and liquidity.”

Along with huge debt hundreds, Envision was toppled by health-care points stemming from the pandemic, Mattress Tub & Past suffered from having a big retailer footprint whereas many purchasers opted for procuring on-line, and Diamond Sports activities was damage by the rise of customers dropping cable TV packages.

“Everyone knows the dangers going through corporations proper now, corresponding to weakening financial progress, excessive rates of interest and excessive inflation,” Ou stated. “Cyclical sectors will likely be affected, corresponding to sturdy customers items, if individuals reduce on spending.”