CRED is in talks to accumulate Kuvera, a startup that operates an internet wealth administration platform, a supply conversant in the matter advised TechCrunch, in what is an indication of the Indian fintech big’s rising curiosity within the profitable class of mutual funds.

The acquisition deliberations are ongoing and a deal might finalize inside weeks, the supply stated, requesting anonymity as the small print are non-public. CRED and Kuvera didn’t instantly reply to a request for remark.

Kuvera, based by trade veterans seven years in the past, focuses on secure and conservative long-term investments and has gained many prosperous clients in India with its zero fee providing, dependable buyer assist service and a wide-range of funding instruments comparable to the power to robotically modify the portfolio to keep away from over reliance on a selected asset.

Kuvera, which has raised about $10 million thus far and has labored with a lot of companies together with Amazon, has an AUM of about $1.4 billion, in line with an individual conversant in the matter.

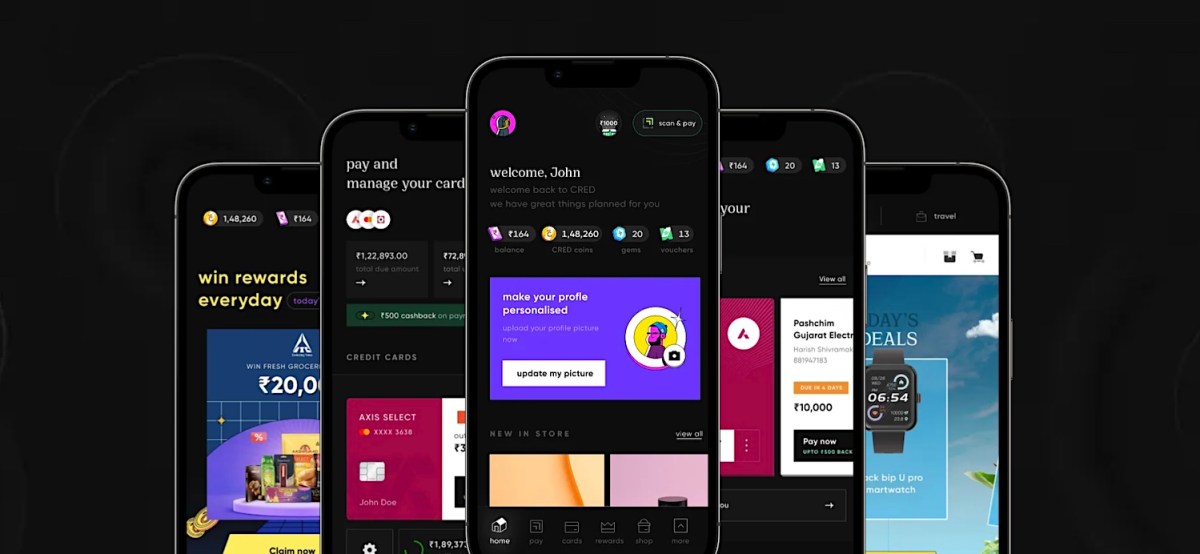

CRED’s curiosity in Kuvera comes at a time when the Indian fintech big, which serves a number of the nation’s most prosperous clients, is increasing its choices. The eponymous app initially launched 5 years in the past with the function to assist members pay their bank card payments on time. It has since added scores of options that incentivize good monetary habits and expanded to e-commerce and lending.

The startup has been eyeing broadening its wealth administration choices for a while. Final yr, it held talks with Bengaluru-headquartered Smallcase, however the talks didn’t materialize right into a deal. (CRED has made a collection of investments previously three years, buying stakes in LiquiLoans and CredAvenue, and shopping for HapPay.)

Mutual fund is usually a profitable class for CRED, which processes a 3rd of all bank card funds in India by quantity.

The Indian mutual fund market is likely one of the largest and fastest-growing on the earth. In accordance with the Affiliation of Mutual Funds in India (AMFI), the belongings beneath administration (AUM) of the Indian mutual fund trade stands at about over $575 billion, up over 20% from a yr in the past.

India’s increasing center class, benefiting from increased disposable incomes, is fueling the expansion of the mutual fund trade. Rising monetary literacy and surge in digital apps have heightened consciousness whereas historic returns have solidified their attraction amongst Indian buyers.