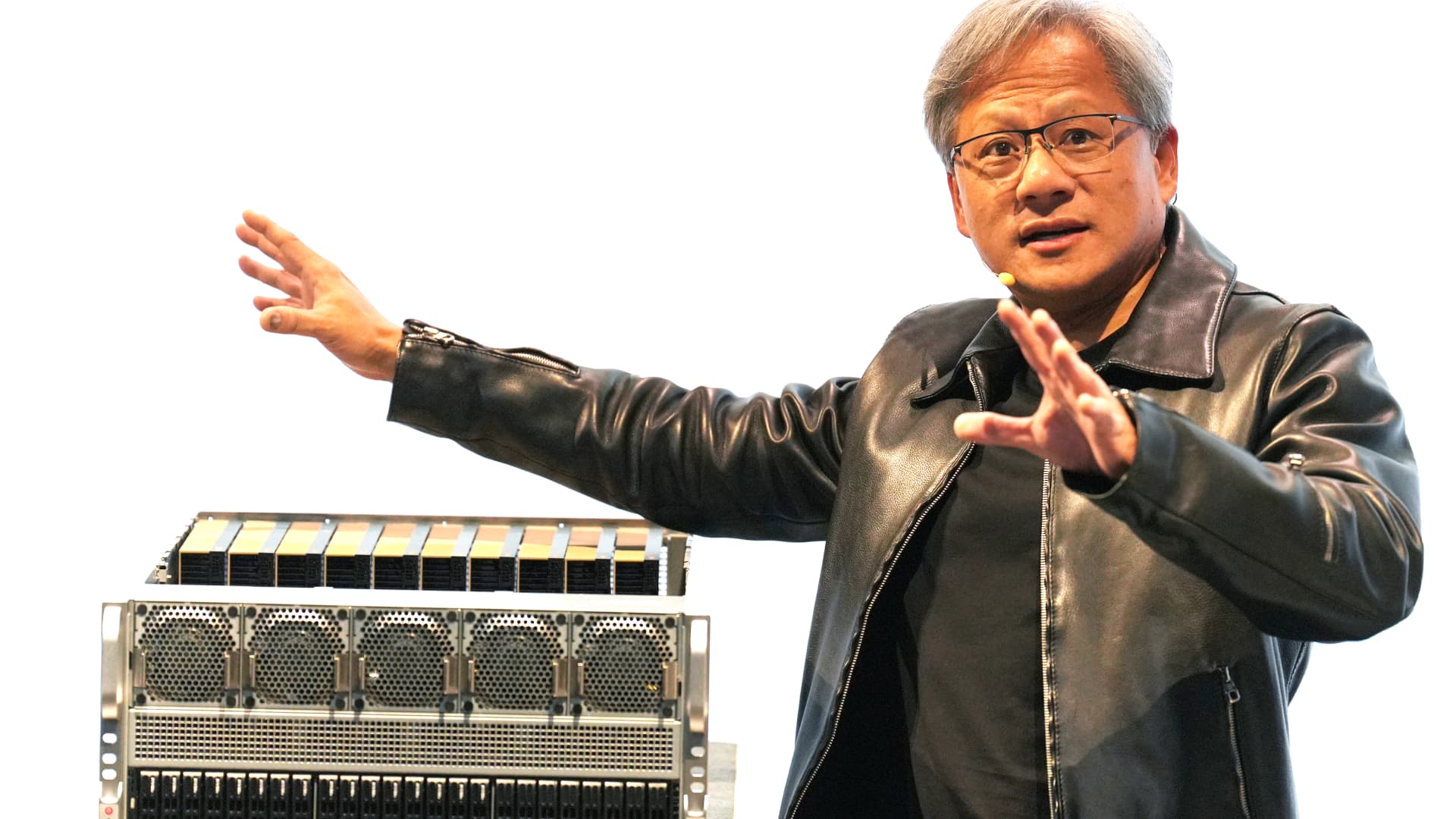

Nvidia CEO Jensen Huang,speaks on the Supermicro keynote presentation throughout the Computex convention in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Pictures | Lightrocket | Getty Pictures

Following final yr’s market route in tech shares, all the business’s massive names have rebounded in 2023. However one firm has far outshined all of them: Nvidia.

Pushed by an over decade-long head begin within the form of synthetic intelligence chips and software program now coveted throughout Silicon Valley, Nvidia shares are up 180% this yr, beating each different member of the S&P 500. The subsequent largest gainer within the index is Fb mother or father Meta, which is up 151% at Friday’s shut.

Nvidia is now valued at over $1 trillion, making it the fifth-most worthwhile U.S. firm, behind solely tech behemoths Amazon, Apple, Microsoft, and Alphabet.

Whereas Nvidia does not carry the family title of its mega-cap tech friends, its core know-how is the spine of the most popular new product that is shortly threatening to disrupt every thing from training and media to finance and customer support. That will be ChatGPT.

OpenAI’s viral chatbot, funded closely by Microsoft, together with AI fashions from a handful of well-financed startups, all depend on Nvidia’s graphics processing items (GPUs) to run. They’re extensively seen as the very best chips for coaching AI fashions, and Nvidia’s monetary forecasts recommend insatiable demand.

The corporate’s highly effective H100 chips value round $40,000. They’re being swept up by Microsoft and OpenAI by the hundreds.

“Lengthy story quick, they’ve the very best of the very best GPUs,” mentioned Piper Sandler analyst Harsh Kumar, who recommends shopping for the inventory. “And so they have them right now.”

Even with all that momentum and seemingly insatiable demand, baked into Nvidia’s inventory worth is a slew of assumptions about progress, together with the doubling of gross sales in coming quarters and the just about quadrupling of web earnings this fiscal yr.

Some traders have described the inventory as priced for perfection. Wanting on the final 12 months of firm earnings, Nvidia has a price-to-earnings ratio of 220, which is stunningly wealthy even in contrast with notoriously high-valued tech firms. Amazon’s P/E ratio is at 110, and Tesla’s is at 70, in line with FactSet.

Ought to Nvidia meet analysts’ projections, the present worth nonetheless seems excessive in comparison with many of the tech business, however definitely extra affordable. Its P/E ratio for the subsequent 12 months of earnings is 42, versus 51 for Amazon and 58 for Tesla, FactSet knowledge reveals.

When Nvidia studies earnings later this month, analysts count on quarterly income of $11.08 billion, in line with Refinitiv, which might mark a 65% improve from a yr earlier. That is barely larger than Nvidia’s official steering of about $11 billion.

Traders are betting that, past this quarter and the subsequent, Nvidia won’t solely have the ability to journey the AI wave for fairly a while, however that it’ll additionally energy by way of rising competitors from Google and AMD, and keep away from any main provide points.

There’s additionally the dangers that include any inventory flying too excessive too quick. Nvidia shares fell 8.6% this week, in comparison with a 1.9% slide within the Nasdaq, with no unhealthy information to trigger such a drop. It is the steepest weekly decline for Nvidia’s inventory since September of final yr.

“As traders, now we have to start out questioning if the thrill round all the nice issues that Nvidia has finished and will proceed to do is baked into this efficiency already,” WisdomTree analyst Christopher Gannatti wrote in a publish on Thursday. “Excessive investor expectations is likely one of the hardest hurdles for firms to beat.”

How Nvidia bought right here

Nvidia’s inventory rally this yr is spectacular, however the true eye-popping chart is the one displaying the 10-year run. A decade in the past, Nvidia was value roughly $8.4 billion, a tiny fraction of chip big Intel’s market cap.

Since then, whereas Intel’s inventory is up 55%, Nvidia’s worth has ballooned by over 11,170%, making it seven instances extra worthwhile than its rival. Tesla, whose inventory surge over that point has made CEO Elon Musk the world’s richest individual, is up 2,279%.

Nvidia founder and CEO Jensen Huang has seen his web value swell to $38 billion, putting him thirty third on the Bloomberg Billionaires index.

An Nvidia spokesperson declined to remark for this story.

Earlier than the rise of AI, Nvidia was identified for producing key know-how for video video games. The corporate, reportedly born at a Denny’s in San Jose, California, in 1993, constructed processors that helped avid gamers render subtle graphics in laptop video games. Its iconic product was a graphics card — chips and boards that had been plugged into client PC motherboards or laptops.

Video video games are nonetheless an enormous enterprise for the corporate. Nvidia reported over $9 billion in gaming gross sales in fiscal 2023. However that was down 27% on an annual foundation, partially as a result of Nvidia bought so many graphics playing cards early within the pandemic, when individuals had been upgrading their programs at dwelling. Nvidia’s core gaming enterprise continues to shrink.

What excites Wall Road has nothing to do with video games. Moderately, it is the rising AI enterprise, underneath Nvidia’s knowledge heart line merchandise. That unit noticed gross sales rise 41% final yr to $15 billion, surpassing gaming. Analysts polled by FactSet count on it to greater than double to $31.27 billion in fiscal 2024. Nvidia controls 80% or extra of the AI chip market, in line with analysts.

Nvidia’s pivot to AI chips is definitely 15 years within the making.

In 2007, the corporate launched a little-noticed software program package deal and programming language known as CUDA, which lets programmers benefit from all of a GPU chip’s {hardware} options.

Builders shortly found the software program was efficient at coaching and working AI fashions, and CUDA is now an integral a part of the coaching course of.

When AI firms and programmers use CUDA and Nvidia’s GPUs to construct their fashions, analysts say, they’re much less more likely to change to rivals, corresponding to AMD’s chips or Google’s Tensor Processing Models (TPUs).

“Nvidia has a double moat proper now in that they they’ve the very best efficiency coaching {hardware},” mentioned Patrick Moorhead, semiconductor analyst at Moor Insights. “Then on the enter facet of the software program, in AI, there are libraries and CUDA.”

Locking in income and provide

As Nvidia’s valuation has grown, the corporate has taken steps to safe its lead and reside as much as these lofty expectations. Huang had dinner in June with Morris Chang, chairman of Taiwan Semiconductor Manufacturing Co.

TSMC, the world’s main producer of chips for semiconductor firms, makes Nvidia’s key merchandise. After the meal, Huang mentioned he felt “completely secure” counting on the foundry, suggesting that Nvidia had secured the provision it wanted.

Nvidia has additionally become a heavyweight startup investor within the enterprise world, with a transparent give attention to fueling firms that work with AI fashions.

Nvidia has invested in no less than 12 startups thus far in 2023, in line with Pitchbook knowledge, together with a few of the most high-profile AI firms. They embody Runway, which makes an AI-powered video editor, Inflection AI, began by a former DeepMind founder, and CoreWeave, a cloud supplier that sells entry to Nvidia GPUs.

The investments might give the corporate a pipeline of rising clients, who couldn’t solely increase Nvidia’s gross sales down the road but in addition present a extra various set of shoppers for its GPUs.

A number of the startups are placing numbers out that present the sky-high ranges of demand for Nvidia’s know-how. Kumar from Piper cited feedback from CoreWeave administration, indicating that the corporate had $30 million in income final yr, however has $2 billion in enterprise contracted for subsequent yr.

“That is the illustration of demand for generative AI kind purposes, or for voice-search purposes, or usually talking, GPU purposes,” Kumar mentioned.

Nvidia is now coming near the midpoint of its present GPU structure cycle. The most recent high-end AI chip, the H100, is predicated on Nvidia’s Hopper structure. Hopper was introduced in March 2022, and Nvidia mentioned to count on its successor in 2024.

Cloud suppliers together with Google, Microsoft and Amazon have mentioned they’ll spend closely to broaden their knowledge facilities, which is able to principally depend on Nvidia GPUs.

For now, Nvidia is promoting practically each H100 it may make, and business individuals usually grumble about how onerous it’s to safe GPU entry following the launch of ChatGPT late final yr.

“ChatGPT was the iPhone second of AI,” Huang mentioned on the firm’s annual shareholder assembly in June. “All of it got here collectively in a easy consumer interface that anybody might perceive. However we have solely gotten our first glimpse of its full potential. Generative AI has began a brand new computing period and can rival the transformative influence of the Web.”

Traders are shopping for the story. However as this week’s risky buying and selling confirmed, they’re additionally fast to hit the promote button if the corporate or market hits a snag.

— CNBC’s Jonathan Vanian contributed reporting.

WATCH: CoreWeave raises $2.3 billion in debt collateralized by Nvidia chips