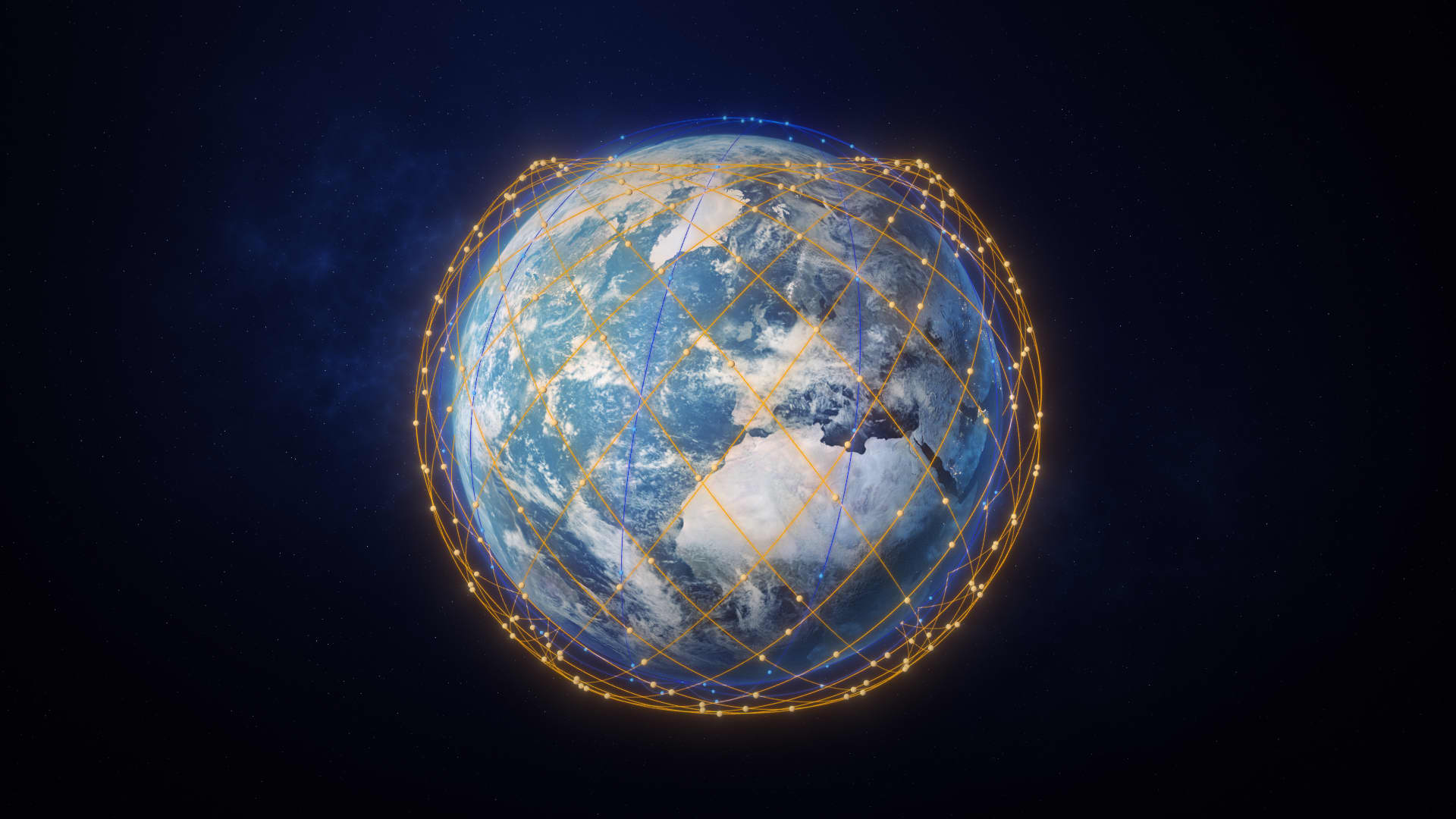

A rendering of Telesat’s low earth orbit broadband constellation.

Telesat

Shares of Canadian telecommunications satellite tv for pc operator Telesat surged Friday after the corporate introduced it will swap suppliers for its deliberate Lightspeed world web community.

Canadian area firm MDA will now construct the Lightspeed satellites, taking the place of French-Italian producer Thales Alenia Area and leading to “whole capital price financial savings” of about $2 billion, Telesat introduced.

The corporate expects to start launching the primary Lightspeed satellites in mid-2026, with world service starting as soon as the primary 156 satellites are in orbit. The total community is deliberate to encompass 198 satellites.

Telesat inventory surged as a lot as 64% with heavy quantity in early buying and selling from its earlier shut at $8.45 a share, earlier than slipping barely to nearer to 50%.

“I am extremely happy with the Telesat group for his or her modern work to additional optimize … leading to dramatically lowered prices,” Telesat CEO Dan Goldberg mentioned in a launch.

Inventory Chart IconStock chart icon

Telesat inventory surges Friday after the corporate swaps its web satellite tv for pc provider.

The corporate had beforehand contracted Thales Alenia Area to fabricate the satellites at an estimated price of $5 billion, together with about $3 billion for the satellites, plus the prices of rocket launches, constructing floor infrastructure and growing software program platforms to function the community.

Enroll right here to obtain weekly editions of CNBC’s Investing in Area e-newsletter.

Goldberg beforehand emphasised to CNBC that Lightspeed will not be meant to compete in direct-to-consumer markets in opposition to SpaceX’s Starlink or Amazon’s Kuiper. As a substitute, it’ll keep Telesat’s current deal with enterprise prospects — authorities and industrial markets that Starlink has expanded into over the previous yr.

Telesat additionally reported second-quarter outcomes Friday, together with $180 million in income, a lower of 4% from the identical interval a yr prior. Telesat’s internet earnings jumped to $520 million within the quarter, in contrast with a internet lack of $4 million a yr prior, a dramatic shift the corporate attributed largely to a $260 million fee from the FCC for clearing spectrum for 5G use within the U.S.

The corporate reaffirmed its full-year 2023 income steering, anticipating to herald between $690 million and $710 million.