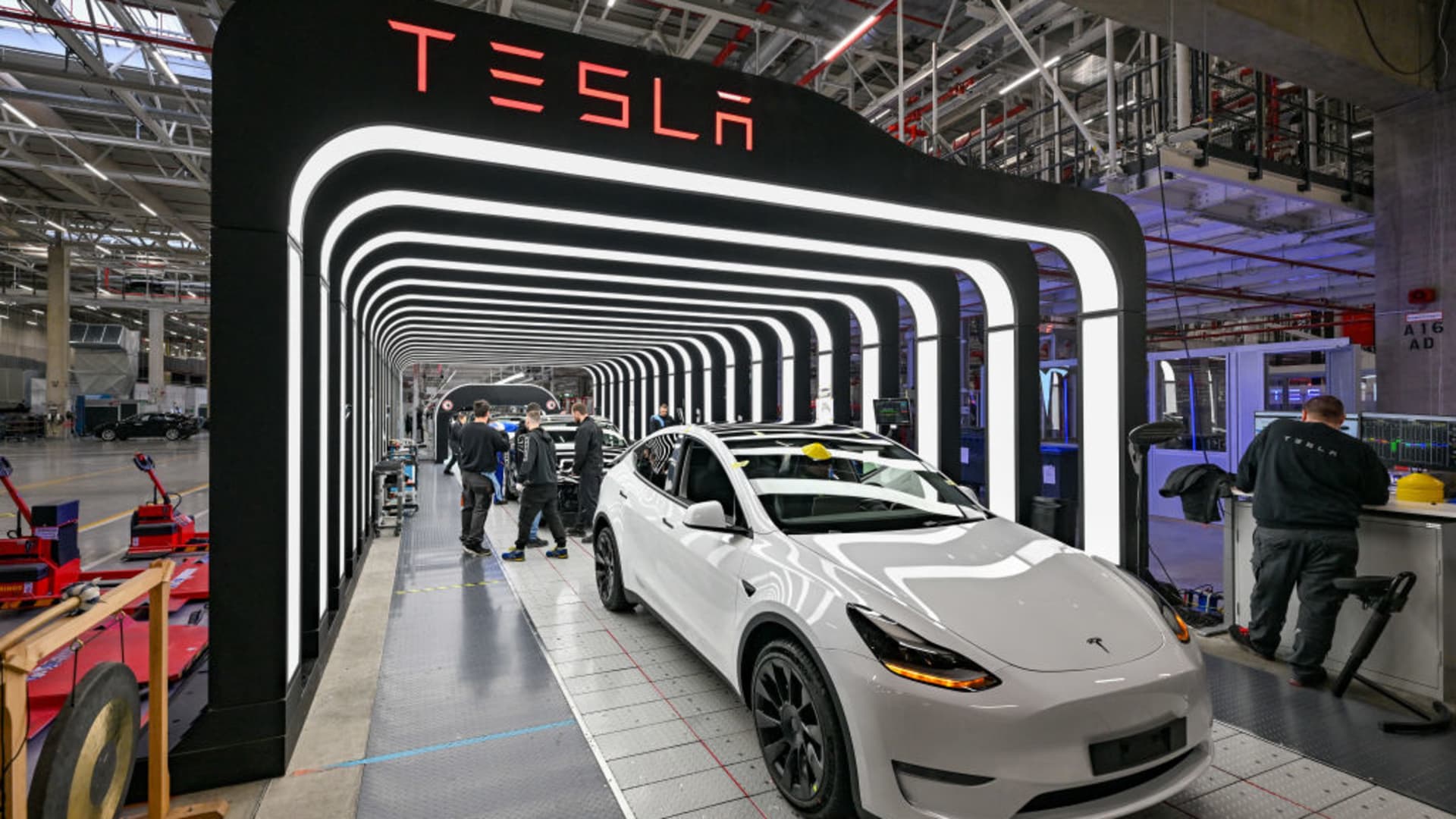

Staff of the Tesla Gigafactory Berlin Brandenburg work on the ultimate inspection of the completed Mannequin Y electrical automobiles. The Tesla plant was opened and put into operation on March 22, 2022.

Patrick Pleuil | Image Alliance | Getty Photographs

Shares in electrical car makers Tesla dropped 4% after the corporate reported first-quarter earnings after the bell. Listed here are the outcomes.

Earnings per share: 85 cents adj. vs 85 cents anticipated, in keeping with the typical analyst estimate compiled by RefinitivRevenue: $23.33 billion vs $23.21 billion anticipated, in keeping with Refinitiv estimates

Web revenue got here in at $2.51 billion, down 24% from final 12 months, whereas GAAP earnings got here in at 73 cents, down 23% from the year-ago quarter.

Tesla specified, in a shareholder deck, that “underutilization of recent factories” confused margins, together with greater uncooked materials, commodity, logistics and guarantee prices, and decrease income from environmental credit, all contributing to the drop in earnings from final 12 months.

Automotive income, Tesla’s core phase, reached $19.96 billion within the quarter, up 18% from final 12 months. Complete income was up 24%.

On an earnings name, CEO Elon Musk stated, “We have taken a view that pushing for greater volumes and a bigger fleet is the fitting selection right here, versus a decrease quantity and better margin.” He additionally emphasised that Tesla expects its automobiles “over time will have the ability to generate vital revenue by means of autonomy.”

When the corporate started to debate its ambitions in self-driving know-how in 2016, Musk stated the corporate would conduct a hands-free journey throughout the US by late 2017. It has but to finish that mission.

Tesla Power income soared to $1.53 billion, up 148% in comparison with the identical interval final 12 months. Tesla’s power storage programs deployment elevated to three.9 GWh, or by 360% the corporate stated. These lithium-ion battery based mostly power storage programs, made by Tesla, embody the house backup battery, referred to as the Powerwall, and the utility-scale Megapack system which allows utilities to retailer adn use extra power generated from renewable, however intermittent, sources like photo voltaic and wind.

Tesla’s first-quarter earnings name was livestreamed by way of Twitter, a primary for the electrical car maker. CEO Elon Musk bought billions of {dollars} value of his Tesla holdings in 2022 to finance a $44 billion buyout of the social media firm, the place he’s now additionally CEO.

The corporate minimize costs on its automobiles on the finish of final 12 months and into the primary quarter of 2023, together with extra cuts Tuesday evening. On the similar time, Tesla is charting formidable plans for enlargement and elevated capital expenditures.

Tesla at present sells 4 EV fashions, that are produced at two car meeting vegetation within the U.S., one in Shanghai and one other exterior of Berlin.

Shareholders who submitted questions forward of the earnings name for administration’s consideration have been searching for updates on the corporate’s trapezoidal, sci-fi impressed Cybertruck, the corporate’s power division, and the timing for a brand new mannequin car from Tesla.

On the decision, Musk stated Tesla is now constructing “alpha variations of the Cybertruck” on a pilot line. The corporate intends to supply the Cybertruck at its Austin, Texas manufacturing unit. Musk stated he anticipates an occasion to kick off Cybertruck deliveries within the third quarter of 2023.

In early April, Tesla reported car deliveries of 422,875 automobiles within the first quarter, the closest approximation of gross sales disclosed by the corporate. Manufacturing was barely greater than deliveries for the primary three months of 2023 at 440,808 automobiles.

A month earlier, Musk introduced plans to construct a Tesla manufacturing unit in Monterrey, Mexico, a day’s drive from a comparatively new manufacturing unit in Austin, Texas. And extra not too long ago, Tesla stated it plans to arrange a manufacturing unit to make Megapacks, or giant lithium ion battery-based power storage programs, in Shanghai.

In accordance with a monetary submitting printed in late January, Tesla anticipated to spend between $7 billion and $9 billion in 2024 and 2025, a rise in capital expenditures of about $1 billion within the subsequent two years.

Tesla shares have rebounded this 12 months from a dismal 2022, after they misplaced about two-thirds of their worth alongside a plunge in tech firms. The inventory is up 48% in 2023.

WATCH: CFRA’s Garrett Nelson bullish on long-term earnings development for Tesla